Ghana’s 2025 national budget, themed “Resetting the Economy for the Ghana We Want,“ sets ambitious fiscal targets to stabilise the economy while addressing critical national concerns. It outlines revenue sources, expenditure plans, and important policy initiatives in light of external and internal economic pressures. The budget aims to balance economic development with fiscal consolidation, with an overall GDP growth rate of 4.0% forecast and an end-period inflation target of 11.9%. However, critical questions remain about sustainability and its impact on citizens. Will the policies translate into real economic relief for businesses and households, or will they impose further financial burdens?

Where Will The Money Come From?

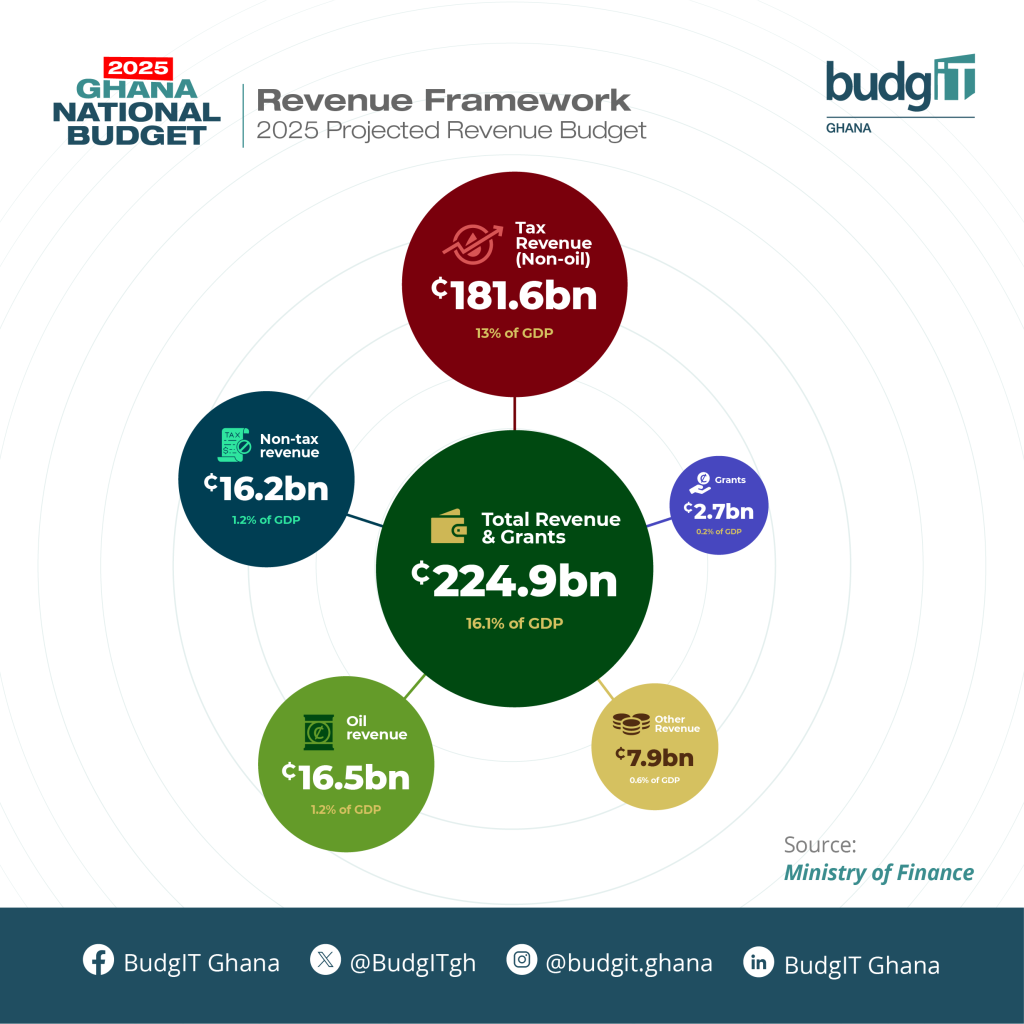

The 2025 budget estimates a total revenue of GH₵224.9 billion, representing 16.1% of GDP. Tax revenue accounts for the majority of revenue, contributing GH₵181.6 billion (13% of GDP). This underscores the government’s reliance on taxes to fund public services and development initiatives. While this may ensure steady revenue generation, it raises concerns about the tax burden on businesses and individuals, especially in a high-inflation climate where disposable incomes are already stretched.

Non-tax revenue derived from fees, levies, and other government charges is set to generate an estimated GH₵16.2 billion (1.2% of GDP). While this diversifies revenue streams, citizens may face higher service prices from government institutions. Ghana’s continued dependence on natural resources is reflected in the projected oil revenue GH₵16.5 billion, accounting for 1.2% of GDP. However, the volatility of global oil prices may impact these estimates, limiting the government’s capacity to meet budgetary commitments. Fiscal expectations from external aid are limited, with GH₵10.6 billion (0.8% of GDP) anticipated from grants and other sources. This indicates a gradual shift towards financial independence but also limits fiscal flexibility.

How is Ghana Spending This Money?

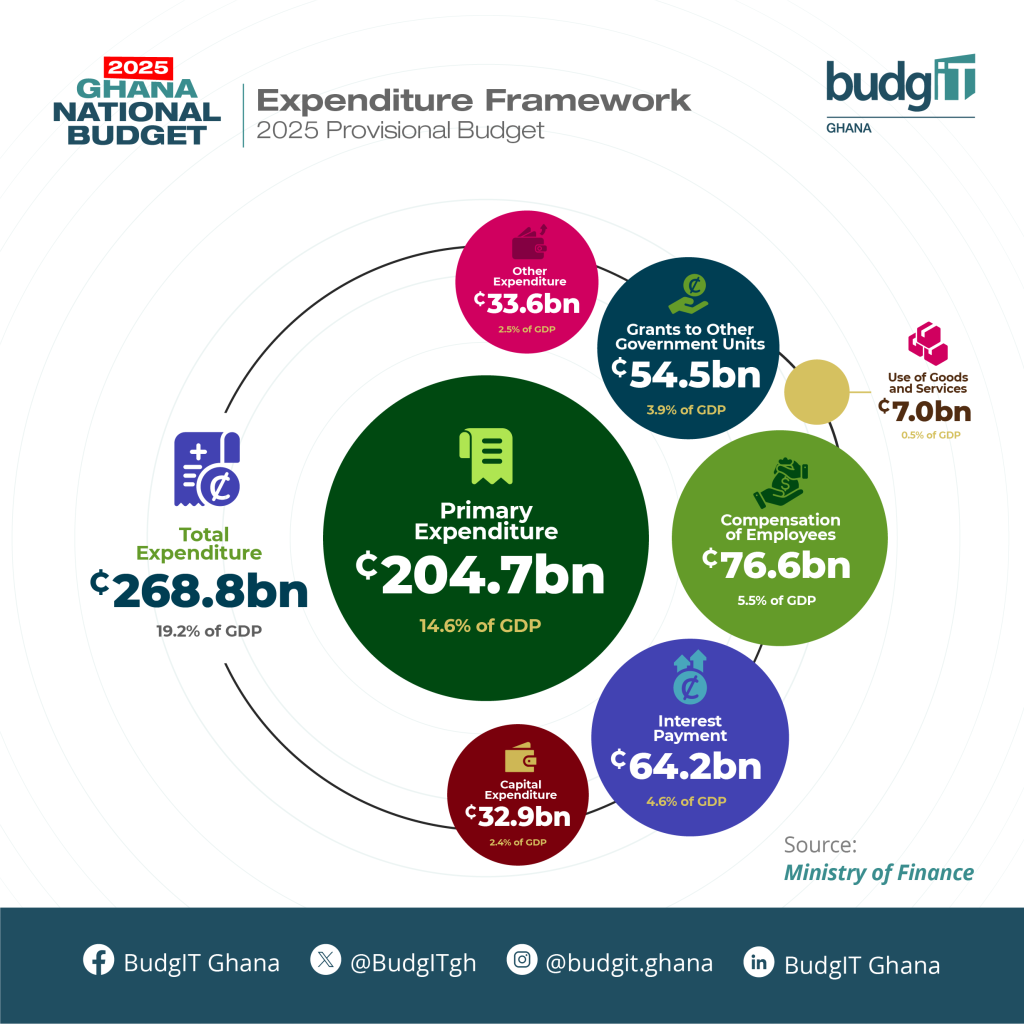

The projected spending for 2025 is GH₵268.8 billion (19.2% of GDP), creating a budget deficit of GH₵43.8 billion (3.1% of GDP). This shortfall will most certainly be funded through borrowing, increasing concerns about Ghana’s financial sustainability. The budget allocates GH₵76.6 billion (5.5% of GDP) for compensation of employees, reflecting the high wage bill in the public sector. While this assures job security for government employees, it reduces fiscal space for capital investments and private-sector stimulation.

Interest payments on public debt amount to GH₵64.2 billion (4.6% of GDP), highlighting the significant strain debt servicing has on national finances. This allocation exceeds the capital expenditure of GH₵32.9 billion, 2.4% of GDP, for infrastructure and development projects. Such an imbalance suggests that Ghana is prioritising past debts over future economic growth, which could hinder progress. These appropriations indicate a desire to sustain public services and governance systems, but concerns about efficiency and accountability in public spending persist.

Spending Priorities for the 2025 Budget

The 2025 budget focuses on critical sectors for national growth. Education receives significant funding, including GH₵3.5 billion for Free SHS, GH₵203 million for teacher trainee allowances, and GH₵499.8 million for the No-Academic-Fee policy, which eases financial constraints but raises worries about education quality and infrastructure. The NHIS receives GH₵9.93 billion in healthcare financing to improve medical access. However, delays in claims payouts and inadequate infrastructure may still exist. The social protection budget includes GH₵1.788 billion for the School Feeding Programme and GH₵292.4 million for free sanitary pads. However, effective implementation of such programs is necessary to stem corruption. Infrastructure investments at GH₵13.85 billion for the Big Push Programme and GH₵2.81 billion for the Ghana Road Fund are crucial for development, yet there are concerns about implementation and cost overruns.

External Influences and Political Affairs Affecting the Budget

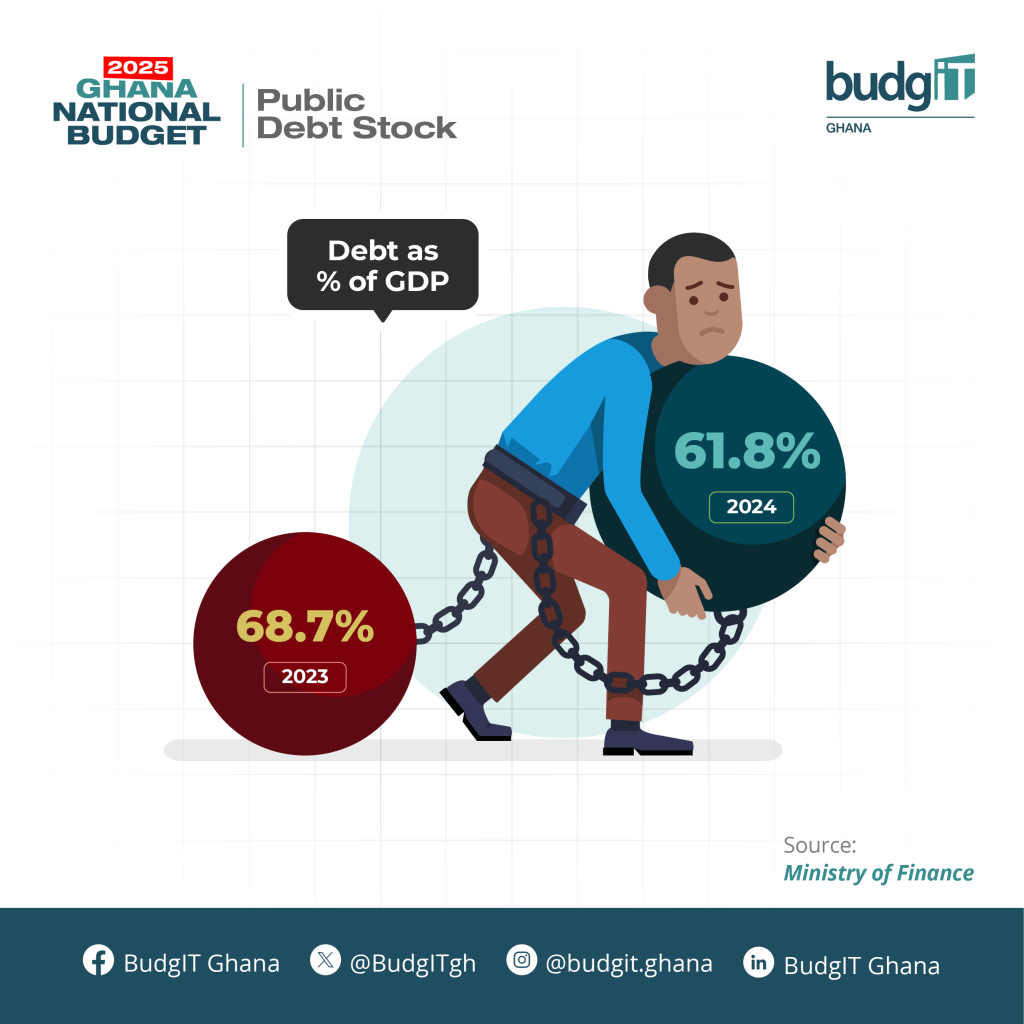

Various external economic conditions, debt obligations, and political underpinnings influence Ghana’s 2025 budget. One of the primary concerns is debt sustainability, as the government attempts to manage its public debt levels through fiscal prudence and restructuring measures. High global interest rates and Ghana’s International Monetary Fund (IMF) Programme have a substantial impact on fiscal policy, notably in expenditure management and revenue mobilisation initiatives.

Fluctuating commodity prices, notably for gold and oil, affect revenue projections since downturns can deepen budget deficits. Political concerns also influence budget priorities, particularly in the wake of the 2024 elections, which could jeopardise fiscal discipline.

What does this mean for citizens?

The budget for 2025 presents both opportunities and challenges for Ghana’s economic stability and progress. The reliance on tax revenue may result in increased enforcement of tax compliance, potentially affecting businesses already struggling with inflation and financial uncertainty. While increased investment in education and healthcare reflects a commitment to human resource development, the efficacy of these investments will determine its long-term success.

The high cost of debt payment calls into question Ghana’s fiscal strategy’s long-term viability. If not adequately managed, continuous borrowing to finance deficits could cause long-term economic instability. Furthermore, investments in private sector growth through entrepreneurship and industrialisation programs benefit job creation and economic diversification. However, the success of these initiatives relies on favourable business policies and access to financing.

There is a need for a strategic approach to balancing fiscal consolidation, social investment, and economic transformation. While the government’s efforts to enhance domestic revenue and streamline expenditure are commendable, challenges such as debt sustainability and global economic uncertainties persist. The success of this budget will depend on disciplined implementation, transparency, and a commitment to prioritising key development areas.