By Abiola Afolabi & Kamal-Deen Hadrat Yussif

Ghana, like the majority of nations, has experienced severe economic and financial difficulties since 2019. The Bank of Ghana recently released an audit report, which revealed it is currently experiencing its worst economic crisis since its founding. Due to the failure of the auctions, the Bank of Ghana lost a staggering $500 million in reserves and accumulated a sizeable overdraft with the government in just two months. With unstable economic conditions and rising inflation rates, the government is struggling to manage its debt obligations and satisfy foreign investors. The Bank shared in its audit report released on July 28, 2023, that the country lost GHS 60 billion (about US $10 billion) due to politicising the government’s domestic debt restructuring exercises.

Here are the top four issues to uncover from the 2022 audit report

- The government’s domestic debt restructuring exercise resulted in the BoG losing GHS 53.1 billion.

The government of Ghana launched a domestic debt restructuring exercise in 2023 to address its unsustainable debt levels. The exercise involved the exchange of old bonds for new bonds with lower interest rates and longer maturities. While it has helped reduce debt servicing costs and made it easier for the government to manage its debt obligations, it has negatively impacted the country’s ability to borrow money and increased inflation rates. Food inflation increased to 59.7% in December 2022, real GDP growth slowed to 3.1% from 5.1% in 2021, and the Ghana cedi lost value cumulatively by 29.9% against the US dollar (as opposed to 4.1% in 2021).

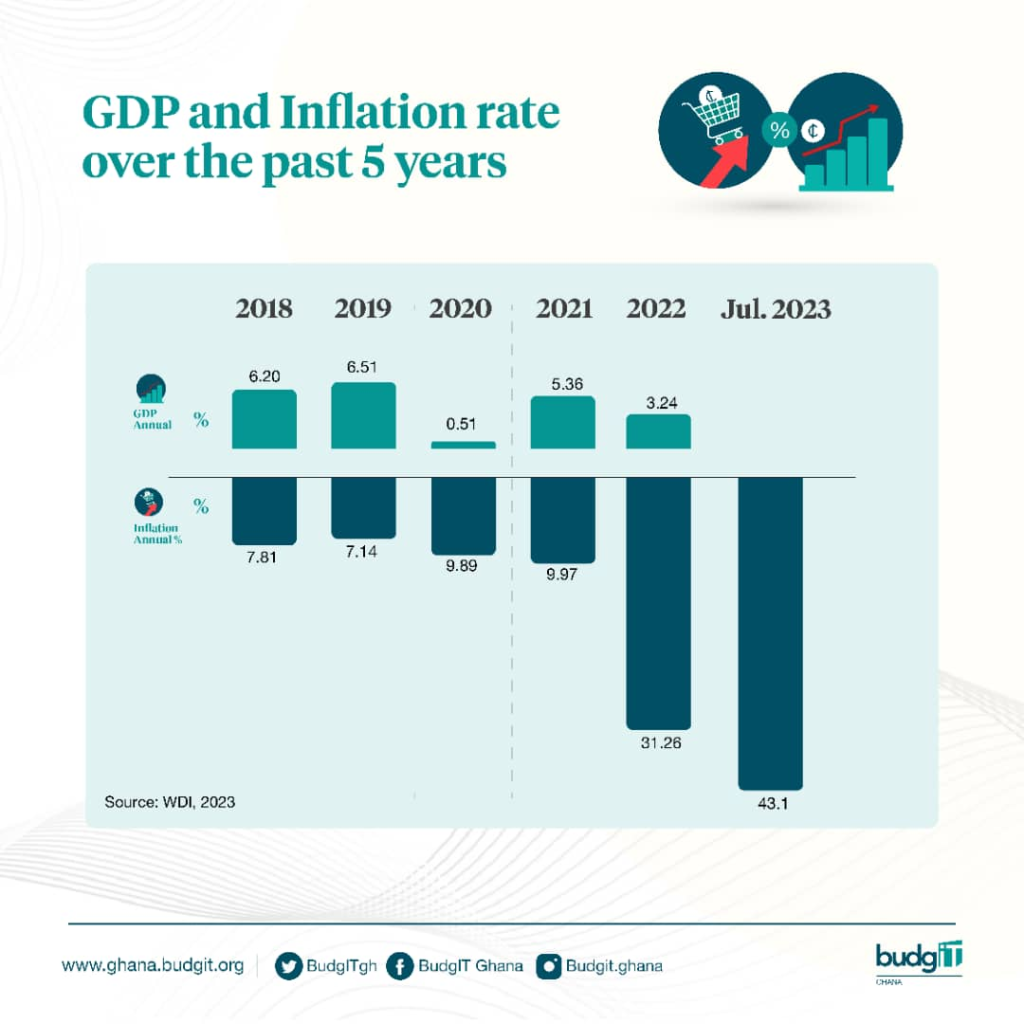

GDP AND INFLATION IN THE LAST FIVE YEARS

Source: WDI, 2023

2. The depreciation of the Cedi resulted in the loss of foreign exchange reserves.

The recent economic woes further exacerbated the depreciation of the Ghana Cedi, with the Cedi trading at GHS 12.50 to the US dollar, a devaluation of more than 50% since 2017. Ghana loses its ability to respond to economic shocks as its currency weakens due to repeatedly high budget deficits, slow economic growth, and high inflation rates. Many foreign investors no longer trust the government’s ability to address this crisis, leading to a massive sell-off of their investment in the country.

3. Non-performing loans exposed the economy, resulting in a loss of reserves of about US$500 million.

The increase in non-performing loans (NPLs) posed a risk to the Ghanaian economy, resulting in a loss of foreign exchange reserves and a loss of $500 million for the Bank of Ghana (BoG). Ghana couldn’t meet its debt obligations and began to lose investor confidence. The ratio of Ghana’s debt to its gross domestic product reached an all-time high of 80% in 2022, which implies that the nation spends more on debt service and less on infrastructure and social services. The price decline of commodities like gold and cocoa has hurt Ghana’s revenues. Recent global events, such as the COVID-19 pandemic and the Ukraine conflict, have also hindered economic growth, increased Ghana’s import bill, and impeded its trade.

4. The BoG had not effectively managed its government debt risks, exposing the economy and resulting in a huge deficit.

The Bank’s ineffectiveness and inability to prepare for the government’s debt restructuring exercise led to a loss of GHS53.1 billion. Its ineffective internal controls resulted in irregularities and leakages of scarce funds. Also, the collapse of BoG-regulated banks such as UT Bank and Capital Bank shows that BoG lacked oversight of its responsibilities towards the banks.

What steps should we take to move forward confidently?

The BoG disclosed in the audit report that it had taken steps to address the problems that had resulted in these losses and a further weakened economy. The Bank is in charge of maintaining price stability while fostering economic expansion and a productive banking and credit system. The Bank must strengthen its framework for risk management and improve the governance of the management of the government’s debt, given the significant role it plays in the economy. The BoG should also put policies in place to recover non-performing loans, boosting investor confidence and luring more foreign direct investment.

While Ghana’s economic crisis cannot be reversed overnight, the government must implement suitable measures and systems to help the country return to an upward economic trajectory. The government of Ghana needs to prioritize investing in its young population and enforce strict measures to combat corruption. It is well known that corruption undermines the economy; therefore, Ghana must adopt good governance principles of accountability and transparency to guarantee the effective use of limited resources. Although autonomous, the Bank of Ghana (BoG) should work in alignment with the parliament to ensure that the Cedi appreciates and strengthens the fragile economy. The Bank must also be transparent in its operations and provide regular audited financial statements to restore public trust, which has been completely eroded. Lastly, the Bank and its board must be committed to resolving these issues by enlisting trusted and experienced professionals to guide the government in its economic policies. This includes strategies for reducing debt, improving export systems, and strengthening the Cedi.

This report has undoubtedly eroded citizens’ trust in the government, which is why we need all hands on deck to ensure Ghana’s financial and economic stability. Citizens, civil society organizations, and public and private institutions must all work together to demand transparency and accountability in government debt and risk management practices. To ensure the prosperity of future generations, citizens must actively participate in governance to influence economic policy decisions that are of paramount importance today.